Yonder: a refreshing take on credit cards

The mission to build the 21st century consumer-obsessed credit company

“When you use your current credit card, what do you feel?”

“My old bank credit card? Nothing, it feels like just a piece of plastic. I definitely don’t get any perks or points! Their mobile app is pretty poor. God forbid if I ever spiral into debt, I could only imagine them charging me excessive interest with glee.”

The above was a snippet of my first conversation with Tim, the CEO and co-founder of Yonder, the UK neo-credit card company breathing a 21st century freshness into a staid industry. He was the one asking me the question, I, the one realising why on earth I was still putting up with my legacy bank’s credit card for the last 10 years 😅.

As a native Brit who has been thankfully fortuitous to date, I realise that I have taken access to credit for granted. But for many here, and especially for folks who emigrate from overseas to make the UK their home, access to credit is often a barrier. Perfect credit scores from past lives don’t matter. Tim had seen this first hard when he moved from Australia to the UK. Despite what would be considered a perfect credit score back in Australia, here it meant nothing; the credit terms offered to him grossly high.

We spoke about the need for a new type of credit card. One that combines accessibility to credit with an enhanced consumer experience that digital-first generations now expect. That educates consumers about the implications of debt to help them manage their credit exposure responsibly and dynamically. One that rethinks the way younger consumers use credit to more align with their preference for experiences. I was bought in after our first conversation.

Last week, Yonder announced a £20m seed round led by Northzone and Localglobe alongside a plethora of brilliant angels to make this vision a reality. They have executed at breakneck speed, cleared regulatory hurdles in record time, and launched a product that is delightful to use.

I occasionally write posts about companies that I either deeply respect or ones where I have been very fortunate to have invested in. Today it’s both! In this post, we’ll be covering the following:

The impending credit card innovation wave

A delicate talent balance - why building a consumer credit proposition is really hard

The pillars of Yonder as a new credit card experience

Credit companionship - the future of credit

The impending credit card innovation wave

As with most technology innovations, fintech evolved in waves. Payments came first with PayPal, Venmo and Stripe. Then debit cards and neobanks with the arrival of Monzo & Revolut in the mid-2010s. Open banking followed alongside with the likes of Plaid, Truelayer and Yapily. And now we’ve seen the continued rise of Klarna, Afterpay, Affirm & more hash it out in the nascent but fast-growing buy-now-pay-later (BNPL) space.

Credit cards have conspicuously been left aside in the fintech revolution to date. Legacy banks have their offerings as a side note to their main banking product suite. Amex still reigns supreme despite getting into the credit card business back in 1958. People with no prior or international credit history lack access. The rewards & experiences feel tired and dated; so does the product user experience (UX). There’s been no significant innovation in the space for the last 70 years.

Yet credit is a massive business for banks. I mean really serious business. This is a $100bn+ market with both high lifetime value (with average income per customer of $180+ per year) and diversified revenue streams (interchange, interest income, subscription, late fees etc). Take a look at the below:

It is an industry primed for disruption, and the ingredients are there. Open banking allows for more intelligent real-time assessment of credit worthiness with true underlying data on a user’s cash flow and spending habits. Infrastructure providers such as Marqeta enable rapid time-to-market with card issuing & processing functionalities. Teams that have cut their teeth at fast-growing fintech startups, armed with both technological and regulatory skills, can now target legacy regulated industries more swiftly than ever before.

Some put down the lack of innovation to the impending death of the credit card. The reality is that this obituary has been on the cards for the last few decades (mind the pun!). The talk of the town is that a combination of BNPL, debt aversion and reduced access to credit have deterred millennials and GenZ from transitioning to credit cards.

There is growing evidence that this indeed is actually not the case. Bankrate found that in 2021, 55% of 18-29 year olds had at least one credit card, up from 33% in 2016. For the 30-49 bracket, 73% had at least one credit card in 2021 up from 55% five years prior. Credit card adoption is up across the board. Alas this is for the US, the home of the credit card. But the UK is not overly too dissimilar in behaviour (i.e. penetration of BNPL is similar across both etc) so a broad comparison is fair. The major difference is that the current credit card offering to UK consumers is far inferior to that granted to our American cousins.

What I think the credit card naysayers have overlooked is that millennials and GenZ are beginning to build wealth over time, albeit more slowly than their parents. BNPL is a great on-ramp for access to credit when you don’t have a credit history at all. But it does not always have universal acceptance, purchase protection, more sophisticated rewards & credit building to name a few. The likely reality is that as millennials and GenZ reach their economic pinnacle they’ll adopt credit cards, BNPL, and other forms of credit together, to pick and choose between them as they go about their daily lives.

So if you hear a proverbial fintech funeral bell, search for whom the bell really tolls, for it will very likely not be the credit card.

A delicate talent balance - why building a consumer credit proposition is really hard

Building a pre-paid debit card & bank account with a mobile app is hard. Building a neo-credit card company is doing that, and then some.

For debit cards and neo-banking, this came down historically to building a beautiful UX supported by a robust transactional backend, and enough regulatory familiarity to navigate an EMI licence1 at the minimum with overhead functions to boot (i.e. fraud, customer support etc). This already is a tall order execution-wise. To add to that then is a smart marketing & brand playbook to keep customer acquisition costs (CAC) low & in check. Monzo led with a smooth product experience & coral-branded cards to drive awareness; Revolut with a unique free FX wedge & communication strategy that played on the negative sentiment felt towards banks post the Great Financial Crisis.

To build a neo-credit card company, you need all the above, with a major regulatory tweak: that is, to get a consumer credit licence. This can be a very painful experience - the barrier to get a consumer credit licence is often far higher than one to get an EMI one. The FCA & other regulators are understandably cautious around consumer credit products to ensure that the everyday user has sufficient protections from predatory lending; consequences of the payday lending sagas of old. This can take 12-14 months, often even more. Yonder achieved it in 9.5 months.

There’s other additions to the melting pot as well. Providing credit requires smart underwriting of consumers’ financial health, intelligent debt facility management and consumer-sensitive collections. Being adept at managing risk is a critical endeavour. And there’s more complexity to brand & loyalty building. Strong credit card propositions offer rewards, experiences and points to foster loyalty, but this requires partnerships & commercial savviness.

Executing all of this is like threading string through a minute eye of a needle. It is tricky, multi-faceted and requires a multi-disciplinary team able to juggle many aspects at once.

To take on this challenge requires a founding team with both a broad and deep relevant skillset. Tim (CEO), Theso (Chief Risk Officer) and Harry (CTO) all come from ClearScore - a British financial technology startup that helped provide consumers with credit reports for free, now valued at over $700m. Credit has been their forte. And they have hired brilliantly well, bringing on talent who have worked at the likes of Monzo, Wise, Amazon & more into the fold. It is therefore no surprise that they have, in record time, built and launched a quality product & credit proposition.

The pillars of Yonder as a new credit card experience

Yonder approaches credit through the dual lens of accessibility and curated experience.

Accessibility to credit comes in many flavours, though primarily it is driven by two factors: the history of the consumer, and the ability of the credit company to understand that history. For younger generations, they simply have not had time yet to build enough credit history. The same applies to those much older who have eschewed credit for much of their life, yet they have a richer economic history. Those that have immigrated may have perfect credit scores in the country of their previous residence but have none in the UK (Tim’s case). Experian terms this ‘credit invisibility’, affecting 5 million people in the country.

Yonder tackles this with open banking to build anew a view on a customer’s creditworthiness from raw transactional banking data. It allows them to serve a significant portion of the ‘credit invisible’ and tap into an underserved and valuable user base. But there’s more. It sets the stage for building a true dynamic relationship with the customer where they can help guide a customer on how to responsibly use credit. That is a potent source of powerful loyalty and brand building.

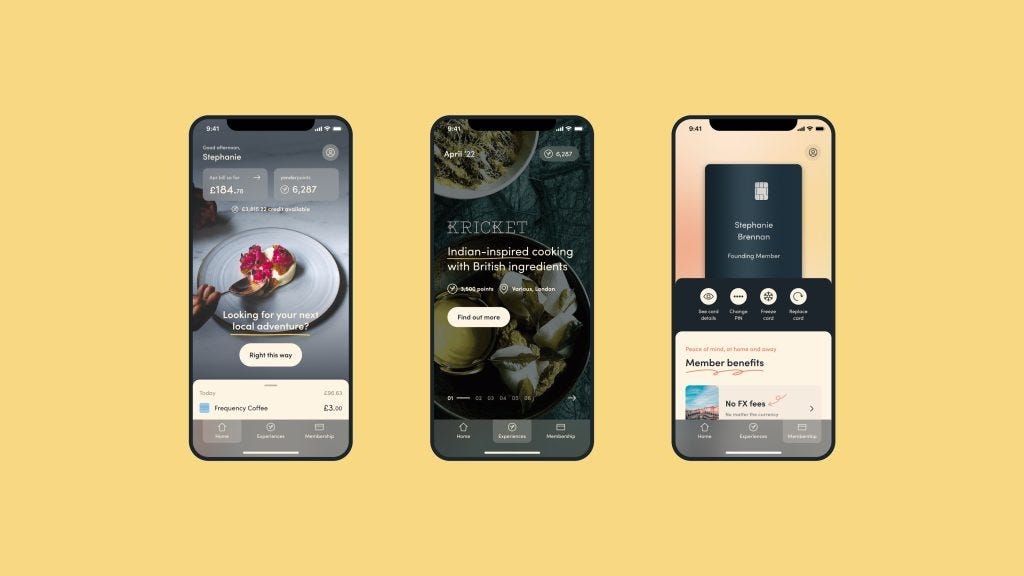

The second key pillar is curated experience. Instead of a replica of Avios points or generic rewards, Yonder has chosen to curate selected experiences within each city, such as unique restaurants and gigs, rotating these every month. They mirror how millennials and GenZ pursue authentic experiences which shy away from big brands in favour of the up-and-coming and the independent - to re-explore your own city. It’s an effective alignment in philosophy with the generation that Yonder seeks to initially serve, and helps cut through the noise & mathematical optimisation that legacy credit companies induce with their points-heavy methodology.

Credit companionship - the future of credit

At the end of the day, a card is still a card. But to view credit cards purely as plastic misses the point of what they serve to be: a companion to the consumer in the realm of providing credit.

The most valuable consumer businesses in history are those that build what I term consumer companionship. That is, they provide a deep and recurring value to their customers that evolves with them over time. Costco enables millions of Americans to access affordable everyday goods with a well-priced yearly subscription. Amazon Prime provides exceptional convenience and more for a monthly fee. Our Netflix and Spotify subscriptions evolve with us as they learn about our content preferences. Apple has created a die-hard tribe of followers who routinely upgrade their devices and swear never to go back to Android or Microsoft (I’m one of them!).

This goes far beyond simply tacking on a subscription for a service. The ideal consumer companions dynamically alter their offerings to make sure that the consumer gets the best value for what they pay. They even eschew profit-making opportunities and draw red lines in the sand to ensure that the customer comes before corporate profits (i.e. Apple’s stance on privacy being a prime example of this). Strong product value and brand awareness combine to drive powerful moats.

In VC parlance, the loyalty these brands can foster drives deep-seated retention, and depending on the market a consumer companion operates in, exceptionally high lifetime value. This in turn gives them the flexibility to tolerate higher CACs to acquire customers whilst maintaining strong profitability, a key advantage over their peers or companies in other markets.

Credit is an ideal market for consumer companionship, and Amex’s historical successful points to this ($140bn+ market cap). It is a key element in most consumers’ financial lives - credit can broaden how we can buy and when, act as a bridge when our cash flow runs dry or is volatile, and open access to products & services that would otherwise require years of saving. But it is equally a two-edged sword. Used irresponsibly or in excess, it can sow the seeds to financial ruin. The opportunity for a consumer credit company to guide a consumer over years to access and pay down credit responsibly is therefore a vast one.

It is a dynamic relationship as well. We evolve as consumers, more so today than ever before as younger generations change jobs more frequently, try their hand more often at freelancing / entrepreneurship, and have less predictable economic lives. Legacy credit card companies are a function of previous salaried generations, and their static offerings a reflection of this. Today’s credit consumer companion would be one that dynamically adjusts to the customer’s economic circumstance, helping them to manage debt when times are tough, and opening up new products & opportunities when it is right for the consumer.

Notice that I don’t refer to a card here. A credit card is but one rail, one avenue for building a credit consumer companion. It is fully feasible to see a credit company combining cards, BNPL, and a myriad of other credit products to provide a full suite of responsible financial products that consumers can access over their lifetime. What matters less is the type of particular financial product itself, but rather the way it is designed to serve the consumer, and how it is communicated to them.

When Tim talks about Yonder, he speaks about a ‘member relationship’, not a banking one. This embodies the spirit of consumer companionship, and why I’m so excited to see what Tim & the team will continue build with Yonder over the years to come.

Yonder is starting off with a select number of Founding Members as they look to build their community, with tons of additional perks (i.e. waived membership fee for 6 months, access to Slack with all the juicy product updates etc). So give it a try - you can sign up here!

Ciao!

Dom

Electronic money licence. This is not a banking licence per se, but a toned-down version that allowed many of the neo-banks to get started holding customer funds and processing transactions. Broadly speaking ignoring some exceptions, this meant that customer funds were segregated and ring-fenced from the company’s own operational accounts; unlike a fully-fledged bank, the neo-bank cannot use these ‘deposits’ for lending purposes.